Someone once said, “Many people look forward to the new year for a new start on old habits.”

Someone once said, “Many people look forward to the new year for a new start on old habits.”

To avoid this, I am kicking off the new year and getting a handle on some of my bad habits by creating small business resolutions worth keeping!

I am gaining control of my email inbox:

This is a biggie. On January 1, I had nearly 15,000 email messages in my inbox! Over the past two years, blogging, social media, my art and writing businesses filled up my inbox. Gaining control over my emails was a chore that I had been dreading for over a year.

Finally last week, I spent at least 5 hours sifting, sorting, and deleting through those thousands of messages. I literally got dizzy from the task, but it feels so good to have only a few hundred in there right now.

I ‘red-flagged’ the most important messages, responded to others, and deleted the rest by using Microsoft Entourage for Mac. Here is a great article with some expert tips on 4 Ways to Take Control of Your Email

I will be ready for the taxman – Save and file receipts:

My son was audited last year. To audit a college student, who hardly had time for a job, sure seemed like a waste of the government’s money. Nevertheless, he had to deal with the headache. Luckily my accountant kept good records for him. But, watching the ‘fun’ my son had to endure made me even more vigilant about keeping good records this year.

“In this era of budget deficits the government is looking for every additional dime of revenue it can find. The IRS has been charged with this task and consequently the risk of an audit is increasing.” ~Michael Beck, CPA

The IRS states that it is important to keep these documents because they support the entries in your books and on your tax return. These documents include paid bills, sales slips, deposit slips, invoices, travel, art supplies, receipts, and canceled checks. It is wise to keep these records in an orderly fashion and in a safe place for tax purposes.

*If you and/or your business returns are selected for audit, be aware of some key provisions to make sure you protect your rights as a taxpayer: The following information was provided by my CPA, Michael Beck at www.AFS4Success.com

- If you keep your businesses records on QuickBooks, the IRS may request and obtain a backup copy of your file on a CD or flash drive. Once they have the file they will be free to “roam” about the data giving them the potential to analyze every entry ever made in the accounting system. There are some tools in the QuickBooks program you can use to limit the scope of the IRS to the year(s) under audit.

- If you are audited by the IRS, it’s possible that the auditor may want to interview you without representation i.e. before you get “lawyered or CPA’d up”. The IRS must inform you of your right to consultation and if you so choose. Once this is in place the IRS is prohibited from speaking to you or your employees directly or touring your place of business without us (a CPA) being present.

I am keeping a log of gas and mileage:

*More expert advice from my CPA: “Business Vehicles…An instructor at one of my continuing education seminars said it best. Under the Internal Revenue Code you don’t get to deduct your business vehicle because you use it in your business. You get to deduct it when you use it in your business AND you keep a contemporaneous log. The point here is clear: You must keep a current log of the business and personal miles driven in any calendar year. If you deduct travel, entertainment, gift or transportation expenses, you must be able to prove (substantiate) certain elements of expenses.” ~Michael Beck, CPA

I am clearing the clutter:

“S P A C E is the breath of Art” ~Frank Lloyd Wright

My studio always needs some TLC and spring cleaning after painting for a big show or meeting a deadline. My computer desk, bulletin board and easel can be found with piles of paper, sticky notes and half-baked paintings. I would rather spend every spare minute painting or writing, rather than cleaning! However, I have learned that dealing with these chores in little bits is a lot easier than letting them build up. I also know that a looming mess will eventually stifle my creativity.

Artists and creatives tend to collect things for inspiration, arts and crafts projects or because we might use it later…but, I am throwing away old paints, dried paintbrushes, magazines and newspapers, bits of this or that – anything I haven’t used in the past year. I am keeping my desk, palette, and easels organized so I have clean spaces to create.

Clutter is a form of procrastination and it causes distraction. The more distractions, the less time we have to focus on working and creating.

‘Here is an equation to remember, Mess = Stress.”

I am prioritizing and limiting distractions:

Many small business owners, including artists like me run home-based businesses. As a professional artist who juggles parenthood and an art career, I have learned the importance of limiting distractions and establishing uninterrupted time for work. I am building clear boundaries and sticking with them.

Setting goals and priorities for the month, work week and day help keep me on task. To help prioritize, I decide which rocks to move first. Big rocks vs. small rocks. Sometimes I work more efficiently by accomplishing the bigger tasks first, then tackling the smaller ones. Other times I prefer to get the minutiae out of the way first.

Social media networks are a vital part of my small business. Social networking can be very alluring to the artist because being an artist is such a solitary profession. Lately, I have been limiting my time on social media. I even set an egg timer to wake me up from my Twitter trance! For more tips from some social media stars, please read Balancing Life and Your Social Networks.

Lastly, I am learning to say ‘no‘! Less is more, and quality over quantity.

“Simplicity is the ultimate sophistication.” ~Leonardo da Vinci

I hope my resolutions for 2012 help you with some ideas for gaining control over your small business, art business or proprietorship, so you can be an even happier, more productive human being!

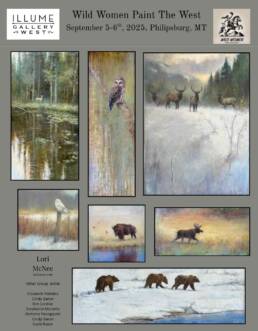

PS. During our break, let’s meet on Twitter and Facebook and Google Plus…and here is my website to view my paintings. ~Lori 😉

How many e-mails??? That’s terrible. I would pass out, ha.

I get edgy if I have more than 100. I have to admit, balancing the social media stuff is a challenge. It’s just so difficult to be everywhere at once unless you’re a good magician of course! That’s going to be one of my areas of focus this year. It will be interesting to see how the new Google search changes things too.

Haha…I am not exaggerating Allison! My inbox growled at me everyday, and it feels great to have the chore behind me. Now, I am catching up on comments! Thanks so much for stooping by. Yes, Google is always full of surprises…

Happy 2012,

Lori

Thanks for this, Lori! I have set some business/art and personal goals this year. I will see how it goes… it’s all still a work in progress and trying to figure out what’s most important and what can reasonably be done is a challenge. I appreciate your hard work and honesty–it’s such an inspiration for me and others! Thanks! Happy 2012 🙂

Hello Allison, it is great seeing you here. I really appreciate your words of encouragement. Sometimes this blogging stuff gets overwhelming, but I take comfort in knowing that I am helping a few others ‘out there’…thanks for letting me know! Happy 2012 to you too.

Cheers-

Lori

Thanks Lori, your blog is a huge and precious resource to be treasured by artists, I’m sure many are very grateful to your work. Best wishes for this year, lots of creativity and inspiration.

Matteo

Dear Matteo,

Artists like you help make this a special place. Thank you for contributing in the past and I always am happy to hear from you…even if I am a bit slow at responding!

Happy 2012,

Lori

I can totally relate to your post. It’s hard to balance our social media life with our day to day tasks. What I started doing last December, I begin with the tasks I put off the very first thing in the moring before I even settle into doing anything else. This has been effective and productive for me.

Best of luck to keeping on track Lori.

Ann

Hi Ann,

I am behind on comments and just noticed this comment. Thanks for the added tip. I am busy working on my resolutions and I am starting to make some progress! Talk to you soon…

Lori 🙂